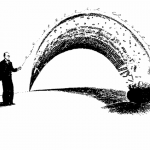

The following portfolio management related excerpts are extracted from Superinvestors of Graham-and-Doddsville, an article based on a speech Warren Buffett gave at Columbia Business School on May 17, 1984 Risk, Expected Return. Volatility “Sometimes risk and reward are correlated in a positive fashion. If someone were to say to me, ‘I have here a […]