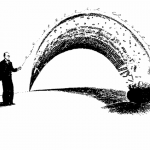

Continuation of portfolio management highlights from Howard Marks’ book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor, Chapter 8 “The Most Important Thing Is…Being Attentive to Cycles” When To Buy, When To Sell “Rule number one: most things will prove to be cyclical. Rule number two: some of the greatest opportunities for gain and […]