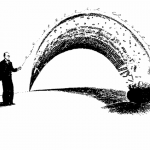

Below is Part 4 of PM Jar’s interview with Howard Marks, the co-founder and chairman of Oaktree Capital Management, on portfolio management. Part 4: The Art of Transforming Symmetry into Asymmetry “If tactical decisions like concentration, diversification, and leverage are symmetrical two-way swords, then where does asymmetry come from? Asymmetry comes from alpha, from superior […]