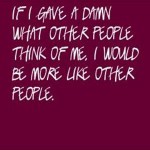

We all have egos in the psychological sense – defined as “a person’s sense of self-esteem or self-importance.” It’s the degree that denotes the positive or negative association that’s often attached to the term “ego.” There are two passages below, one from Howard Marks and the other from Warren Buffett, that share a common denominator: […]