James Montier’s Value Investing: Tools and Techniques for Intelligent Investment is a book I often recommend to others – Montier does a wonderful job of pulling together a range of topics related value investing. Below are excerpts from Chapter 16 titled “Process not Outcomes: Gambling, Sport and Investment.” Montier derived much of the content below (story & matrix) from Michael Mauboussin’s book More Than You Know – Chapter 1.

Process Over Outcome, Mistakes, Psychology, Luck

“We have no control over outcomes, but we can control the process. Of course, outcomes matter, but by focusing our attention on process we maximize our chances of good outcomes.”

“Psychologists have long documented a tendency known as outcome bias. That is the habit of judging a decision differently depending upon its outcome.”

“Paul DePodesta of the San Diego Padres and Moneyball fame relates the following story on playing blackjack:

‘On one particular hand the player was dealt 17 with his first two cards. The dealer was set to deal the next set of cards and passed right over the player until he stopped her, saying: ‘Dealer, I want to hit!’ She paused, almost feeling sorry for him, and said, ‘Sir, are you sure?’ He said yes, and the dealer dealt the card. Sure enough, it was a four.

The place went crazy, high fives all around, everybody hootin’ and hollerin’, and you know what the dealer said? The dealer looked at the player, and with total sincerity, said: ‘Nice hit.’ I thought, ‘Nice hit? Maybe it was a nice hit for the casino, but it was a horrible hit for the player! The decision isn’t justified just because it worked…’

The fact of the matter is that all casino games have a winning process – the odds are stacked in the favour of the house. That doesn’t mean they win every single hand or every roll of the dice, but they do win more often than not. Don’t misunderstand me – the casino is absolutely concerned about outcomes. However, their approach to securing a good outcome is a laser like focus on process…

Here’s the rub: it’s incredibly difficult to look in the mirror after a victory, any victory, and admit that you were lucky. If you fail to make that admission, however, the bad process will continue and the good outcome that occurred once will elude you in the future. Quite frankly, this is one of the things that makes Billy Beane as good as he is. He’s quick to notice good luck embedded in a good outcome, and he refuses to pat himself on the back for it…’

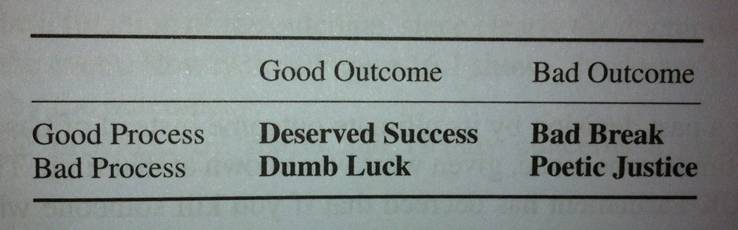

To me the similarities with investment are blindingly obvious. We are an industry that is obsessed with outcomes over which we have no direct control. However, we can and do control the process by which we invest. This is what we should focus upon. The management of return is impossible, the management of risk is illusory, but process is the one thing that we can exert influence over.”

“Outcomes are highly unstable in our world because they involve an integral of time. Effectively, it is perfectly possible to be ‘right’ over a five-year view and ‘wrong’ on a six-month view, and vice versa…During periods of poor performance, the pressure always builds to change your process. However, a sound process can generate poor results, just as a bad process can generate good results.”