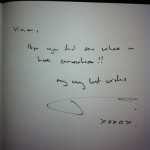

I have a confession to make: I have a huge crush on James Montier. I think the feeling might be mutual (see picture below, from a signed copy of his book Value Investing: Tools and Techniques for Intelligent Investment.) Jokes aside, below are some fantastic bits from his recent essay titled “No Silver Bullets.”

Risk, Correlation

“…private equity looks very much like public equity plus leverage minus a shed load of costs…hedge funds as an ‘asset class’ look like they are doing little more than put selling! In fact, I’d even go as far as to say if you can’t work that out, you probably shouldn’t be investing; you are a danger to yourself and to others!

The trick to understanding risk factors is to realize they are nothing more than a transformation of assets. For instance, what is the ‘equity risk?’ It is defined as long equities/short cash. The ‘value’ risk factor is defined as long cheap stocks/short expensive stocks. Similarly, the ‘momentum’ risk factor is defined as long stocks that have gone up, and short stocks that have done badly. ‘Carry’ is simply long high interest rate currencies/short low rate currencies. Hopefully you have spotted the pattern here: they are all long/short combinations.”

Proper investing requires an understanding of the exact bet(s) that you are making, and correct anticipation of the inherent risks and correlated interactivity of your holdings. This means going beyond the usual asset class categorizations, and historical correlations. For example, is a public REIT investment real estate, equity, or interest rate exposure?

For further reading on this, check out this article by Andy Redleaf of Whitebox in which he discusses the importance of isolating bets so that one does not end up owning stupid things on accident. (Ironic fact: Redleaf and Montier have butted heads in the recent past on the future direction of corporate margins.)

Leverage

“…when dealing with risk factors you are implicitly letting leverage into your investment process (i.e., the long/short nature of the risk factor). This is one of the dangers of modern portfolio theory – in the classic unconstrained mean variance optimisation, leverage is seen as costless (both in implementation and in its impact upon investors)…

…leverage is far from costless from an investor’s point of view. Leverage can never turn a bad investment into a good one, but it can turn a good investment into a bad one by transforming the temporary impairment of capital (price volatility) into the permanent impairment of capital by forcing you to sell at just the wrong time. Effectively, the most dangerous feature of leverage is that it introduces path dependency into your portfolio.

Ben Graham used to talk about two different approaches to investing: the way of pricing and the way of timing. ‘By pricing we mean the endeavour to buy stocks when they are quoted below their fair value and to sell them when they rise above such value… By timing we mean the endeavour to anticipate the action of the stock market…to sell…when the course is downward.’

Of course, when following a long-only approach with a long time horizon you have to worry only about the way of pricing. That is to say, if you buy a cheap asset and it gets cheaper, assuming you have spare capital you can always buy more, and if you don’t have more capital you can simply hold the asset. However, when you start using leverage you have to worry about the way of pricing and the way of timing. You are forced to say something about the path returns will take over time, i.e., can you survive a long/short portfolio that goes against you?”

Volatility, Leverage

“As usual, Keynes was right when he noted ‘An investor who proposes to ignore near-term market fluctuations needs greater resources for safety and must not operate on so large a scale, if at all, with borrowed money.’”

Expected Return, Intrinsic Value

“…the golden rule of investing holds: ‘no asset (or strategy) is so good that it can it be purchased irrespective of the price paid.’”

“Proponents of risk parity often say one of the benefits of their approach is to be indifferent to expected returns, as if this was something to be proud of…From our perspective, nothing could be more irresponsible for an investor to say he knows nothing about expected returns. This is akin to meeting a neurosurgeon who confesses he knows nothing about the way the brain works. Actually, I’m wrong. There is something more irresponsible than not paying attention to expected returns, and that is not paying attention to expected returns and using leverage!”

Hedging, Expected Return

“…whenever you consider insurance I’ve argued you need to ask yourself the five questions below:

- What risk are you trying to hedge?

- Why are you hedging?

- How will you hedge?

- Which instruments will work?

- How much will it cost?

- From whom will you hedge?

- How much will you hedge?”

“This is a point I have made before with respect to insurance – it is as much a value proposition as anything else you do in investment. You want insurance when it is cheap, and you don’t want it when it is expensive.”

Trackrecord, Compounding

“…one of the myths perpetuated by our industry is that there are lots of ways to generate good long-run real returns, but we believe there is really only one: buying cheap assets.”